Receive a Tax Credit While Empowering Children to Experience an Improved Quality of Life

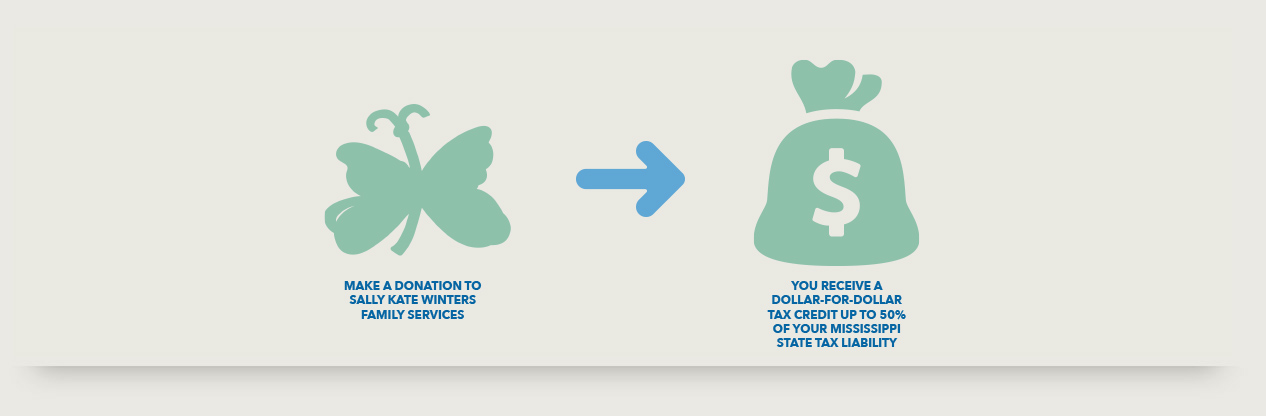

The State of Mississippi offers a tax credit for donations made to an eligible Qualified Charitable Organization. Your donation to Sally Kate Winters Family Services can be a DOLLAR-FOR-DOLLAR TAX CREDIT on your Mississippi taxes representing up to 50% of a business tax liability.

Please Note: The Mississippi Department of Revenue (DOR) has allocated the $5,000,000 funds available for 2021 calendar year.

Use These Steps:

Complete the Mississippi State Department of Revenue application for tax credit allocation. MSDOR shall send notification of allocation.

Make a donation to Sally Kate Winters Family Services to receive a tax credit.

Send verification of the contribution to the Mississippi State Department of Revenue (Must be received within 60 days of notification of allocation).

The bulletin offering more information regarding ECO’s and the related income tax credit can be reviewed through the Technical Bulletin here. Information regarding eligible charitable organizations pertaining to the Mississippi Children’s Promise Act is available on the Mississippi Department of Revenue website.

FAQ's about the Children's Promise Act Tax Credit:

A tax credit is available for voluntary cash contributions to an eligible charitable organization. The credit is only available to a taxpayer who is a business enterprise engaged in commercial, industrial or professional activities and operating as a corporation, limited liability company, partnership, or sole proprietorship. A contribution to an eligible charitable organization used for the Eligible Charitable Business Contribution Tax Credit cannot be used for the Charitable Business Contribution Tax Credit or Foster Care Charitable Tax Credit.

1.800.RUNAWAY

SOMEPLACE TO GO.

SOMEONE TO HELP.

TEXT 4 IMMEDIATE HELP:

TEENS TEXT THE WORD "SAFE"

AND YOUR CURRENT LOCATION

(STREET ADDRESS, CITY, STATE)

TO 44357.