Receive a Tax Credit While Empowering Children to Experience an Improved Quality of Life

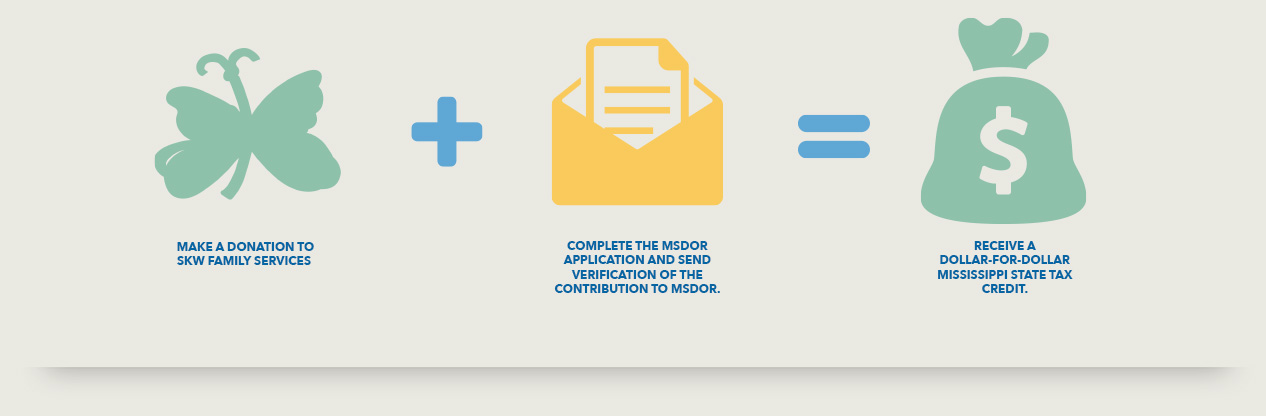

Beginning January 1, 2021, at 12:00 am through the Children’s Promise Act, individuals and business can receive a Mississippi tax credit for donations made to Sally Kate Winters Family Services. As a designated, eligible Qualified Charitable Organization, donations made to Sally Kate Winters Family Services meet the basic criteria required for the Mississippi tax credit.

Businesses can donate up to 50% of their Mississippi tax liability to Sally Kate Winters Family Services instead of paying taxes to the State of Mississippi. Individuals can receive a tax credit, too. The Mississippi Children’s Promise Act is a wonderful way to have control over how your tax dollars are spent.

The bulletin offering more information regarding ECO’s and the related income tax credit can be reviewed through the Technical Bulletin here. Information regarding eligible charitable organizations pertaining to the Mississippi Children’s Promise Act is available on the Mississippi Department of Revenue website.

ATTENTION: A limited number of credits are available per calendar year. The new 2021 application is available. Please make sure you use the most updated application for business and individuals' credits.

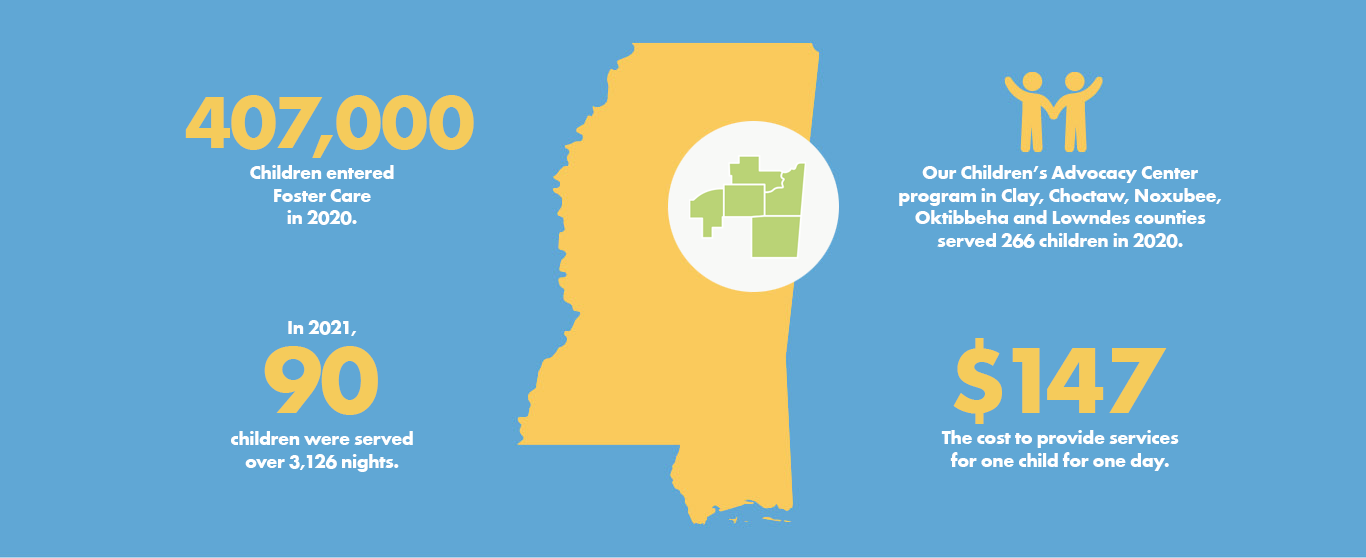

CHOOSE SALLY KATE WINTERS FAMILY SERVICES & MAKE A REAL IMPACT WITH YOUR TAX DOLLARS

CHILDREN'S PROMISE ACT TAX CREDIT

FOR BUSINESSES

CHILDREN'S PROMISE ACT TAX CREDIT

FOR INDIVIDUALS

1.800.RUNAWAY

SOMEPLACE TO GO.

SOMEONE TO HELP.

TEXT 4 IMMEDIATE HELP:

TEENS TEXT THE WORD "SAFE"

AND YOUR CURRENT LOCATION

(STREET ADDRESS, CITY, STATE)

TO 44357.